Use Your Hsa/fsa For Massage

Ok, Ill have to apologize to those who didnt know, but Ive been accepting Health Savings Accounts and Flex Spending Accounts for a while now. I know these accounts have become more popular due to higher deductible plans and many companies contribute to these accounts. For the moment, these accounts are the next best thing to accepting insurance in my practice.

Remember This Computer / Device

Would you like this system to remember this computer or device so you will not need to enter a one-time PIN the next time you access your account from this particular computer or device?

There is no limit to the number of computers / devices that can be remembered for your account.

To ensure the security of your account, all remembered devices will be forgotten each time you reset your username or your password .

- Yes, remember this device.

Also Check: Massage Envy Denver Tech Center

How To Use Your Fsa For Your Massage With Riviera Spa

If you suffer from one of the above conditions, all you need to do to set up massage as a qualifying expense is pay a visit to your medical practitioner. Let him or her know that you have an FSA or HSA and youd like to use some of your funds toward massage for treatment or prevention of your condition.

Your physician will need to provide three pieces of information on the prescription:

1. Medical necessity: why you need massage therapy 2. Frequency: number of sessions per month 3. Duration: length of treatment

Once youve obtained the prescription, file it away in case you are ever asked to back up the expense. Its not necessary to bring the prescription to Riviera Spa, but you should bring your FlexCard to pay for your next visit. If you dont have a FlexCard, simply pay for our massages and turn in your receipts for reimbursement. Note that you cant include tips or pay for your entire membership upfront.

You May Like: Massage Therapist Upper West Side

What Is A Flexible Spending Account

An FSA is an employer-sponsored healthcare benefit that allows employees to set aside up to $2,850 annually to cover the cost of qualified medical expenses. Its a lot like a savings account but used for qualified health-related costs. FSAs work on an annual plan year basis and are funded through regular payroll deductions on a pre-tax basis.

These funds are subject to a use-it-or-lose-it rule, which means that any funds that are unspent by the end of each plan year are forfeited to the account holders employer. That means you lose your remaining money if you miss the deadline for spending it all, so always keep track . But some accounts might have a lifeline as employers have the option of offering one of two deadline extensions: the FSA Grace Period or the $570 rollover.

Quick overview: The FSA Grace Period gives account holders up to 2.5 months after the end of their plan year to spend their remaining FSA dollars, while the $570 rollover allows employees to move up to $570 into next years account not a bad deal if your plan has one of these options!

But not all plans have them. To be 100% sure about when you need to use your money, ask your HR department to give you more specifics about the plan.

Massage Therapy: Fsa Eligibility

Massage therapyrefers to a manual manipulation of the body’s soft tissues to treat a specific medical condition, injury or to enhance an individual’s overall health and well-being, and is often considered a complementary and alternative form of medicine . While there are a variety of massage disciplines and techniques, the most common types are via WebMD:

- Trigger Point – This technique emphasizes the therapy of “target points,” tight areas within muscles that can cause pain in other parts of the body. These groupings of muscle fibers are typically formed from injury or overuse.

- Deep Massage – By utilizing slower, forceful strokes to target an affected area, deep massage penetrates lower muscle layers to provide therapy to muscles and connective tissue to treat damage associated with injuries.

- Swedish Massage – This is the most common form of massage therapy categorized by its softer, longer strokes and tapping strokes on the topmost layer of muscles to relieve tension.

- Sports Massage – Similar to Swedish massage, sports massage specializes in treatment of sports-related injuries, as well as providing a complement to traditional rehabilitation practices.

What is the process of massage therapy FSA reimbursement?

Read Also: Massage Cream For Face At Home

What Are Fsa And Hsa

Before we dive into the process of using your FSA or HSA for a massage, lets have a brief overview of what these are.

FSAs and HSAs are types of healthcare plans that enable you to save money for qualified medical expenses such as monthly prescriptions, deductibles, coinsurance, and copayments.

You can get a comprehensive list of costs eligible as medical expenses from the IRS. You can also have your employer contribute money to your FSA or HSA yearly.

Usually, both of these healthcare arrangements are linked to a debit card with your contributions included. Although FSAs and HSAs differ in some aspects such as roll-over, they generally work the same when it comes to paying for a massage.

How Do I Use My Fsa/hsa

The first step in using your FSA or HSA money for massage therapy is to pay a visit to your primary care doctor. Let the doctor know you have an FSA or HSA and are seeking massage therapy as the solution to a medically eligible condition. The doctor will write a prescription for your massage if he/she deems it to be medically necessary.

Your prescription will need to include the following:

- A reason for your massage therapy treatment, such as a medical condition or to relieve chronic back pains.

- The number of sessions youll need or the frequency of your visits

- The length of the treatments needed.

Once you have received the prescription, file it away in case you are asked to show proof of the expense. You can use your FSA/HSA card to pay for massage services online or in-person. Just remember, tips are not considered a medical expense.

You May Like: Hand And Stone Massage Asheville Nc

Hsa And Fsa: What Are They

Before we discuss the process of getting a massage with your insurance plan, lets do a quick overview on HSAs and FSAs. These are both special healthcare arrangements that allow you to set aside money for medical costs, such as deductibles, monthly prescriptions, copayments, and coinsurance. You dont pay taxes on this money.

For a detailed list of what costs are considered medical expenses, start with this fact sheet from the IRS. In some cases, your employer will contribute money to your HSA or FSA each year as well. Both of these plans have a lot of fine print youll need to consider, so talk to your HR department if you have questions.

These healthcare plans usually come with a debit card that includes your contributions. In most cases, you wont have to worry about being reimbursed, as your funds will already be on the flex debit card. You can spend this on any of the above medical costs.

What Is A Health Savings Or Flexible Spending Account

A Health Savings Account is a type of savings account that allows you to set aside money on a pre-tax basis to pay for qualified medical expenses, but is generally tied to a High Deductible Health Plan . A Flexible Spending Account is a a special account you put money into that you use to pay for certain out-of-pocket health care costs that is also tax-free. Any modality massage therapy that is prescribed by a medical professional is considered a qualified medical expense under many plans.

An HSA is great way to get the most out of your High Deductible Health Plan. Your HSA allows you to save up money in case disaster strikes while maintaining the lower monthly payments of an HDHP. These funds can be used in conjunction with health insurance to provide the best overall care by allowing for services that may not be covered by health insurance, like massage therapy for injury recovery or helping improve circulation hampered by diabetes.

A Health Savings Account and a Flexible Spending Account are both pre-taxed payroll deductions. In other words, less of your pay check is taxed which lowers your taxable income. A Health Savings Account and/or Flexible Spending Account can beneficially impact the amount of taxes you may owe or get back at the end of the year.

Also Check: Can Massage Help Reduce Belly Fat

Can A Massage Therapist Write A Medical Necessity Letter

Massage therapy, when used to treat a medical condition, may be eligible with a Physicians Letter of Medical Necessity . Read also : Does deep tissue massage help with cellulite?.

How do I get a doctors letter?

A patient can write the letter, but it must be made official by a doctor. Ultimately, all arguments for a service must come from the attending physician. That is, the doctor must know you, have an anamnesis with him, and at the end either write or sign the letter.

Can a Chiropractor Write a Medical Need Letter?

A doctor, chiropractor, physical therapist, occupational therapist, or registered nurse can all provide you with a letter of medical necessity for an ergonomic chair or standing angle chair. Sometimes it can be beneficial to have more than one healthcare professional sign the letter.

How To Use Your Hsa Or Fsa Card For Massage

Did you know that it is possible to pay for massage with your HSA or FSA cards? Thats right! You totally can! But there are a few things to know about before you do to make sure youre covering all your bases with the IRS. Here is the lowdown on everything you need to know about massage and HSA/FSA cards.

What is an HSA or FSA?

HSAs and FSAs are tax-advantaged accounts that allow you to set aside pre-tax funds from your paycheck towards medical expenses. They can be used for a wide variety of different things, most commonly co-pays, out of pocket medical expenses, medications, etc. But there is a whole long list of things that they can cover, including massage!

What is the difference between an HSA and an FSA?

The most noticeable difference between the two is that the funds in an FSA have to be used up by the end of the year, while the funds in an HSA roll over from year to year. HSAs allow a lot more freedom as well, allowing you to invest the money into a 401K if you want or even just withdrawing it . If you want to learn more details about the two types of accounts there is a fantastic article HERE.

How do I use my HSA or FSA to pay for massage?

Technically there is nothing stopping you from using your card anywhere you want, but if you spend the money on things that aren’t approved the IRS might come after you. And that’s pretty much the last thing any of us need! So follow these simple steps and you will be all set!

4. Book your appointment!

5. Enjoy!

Be well!

Don’t Miss: Labor Laws For Massage Therapists

What Conditions That Qualify For Getting An Fsa Account

Here Ive shared some types of illnesses that can qualify you.

- Anxiety

- Chronic fatigue

- Other body pain

Pain arthritis, anxiety, depression, and pain management are the most common things. Those are some common problems why most people take body massage therapy. If you are suffering one of them, consult with your physician to know what to do. Then apply for the FSA account or card.

Is Massage Therapy Eligible

The expenses eligible for reimbursement through your Health FSA are generally defined by your FSA administrator . These can vary signficantly depending on the terms of your plan.

Although IRS Publication 502 does not specifically mention massage therapy, it states the following under the general heading of Therapy: You can include in medical expenses amounts you pay for therapy received as medical treatment.

Please be sure to check with your employer about the specifics related to massage therapy under your plan. If massage therapy is included, you will likely be required to provide proof of medical need in the form of a prescription or doctors order to obtain reimbursement.

Recommended Reading: Academy For Massage Therapy Training Park North

Any Other Tips For Using My Hsa/fsa For Massage

When you go to your doctor to ask for a prescription for massage, be honest about your reasons for seeking this type of treatment. Massage therapy can be a great way to improve your health, healing and overall wellbeing, so there is no need to invent injuries or illnesses. Dr. McClain again is happy to help.

Likewise, be sure to use your HSA/FSA only for massages that are covered by your prescription, and to keep good records for tax purposes. Massage therapy offers many health benefits, and an HSA or FSA can help keep your wallet healthy too.

You Could Be A Candidate For Trigger Point Therapy Or Neuromuscular Massage For Trigger Point Pain !FOR MORE INFORMATION CALL 310-798-4263 OR GO TO www.MassageRevolution.com

The Back & Neck Relief Center 500 S. Sepulveda Blvd Suite 101Manhattan Beach, CA 90266

Which Massage Guns Are Hsa Eligible

There are some massage guns on the internet that support HSA or FSA. Also on Amazon, you can find massage guns with eligibility.

Zarifa Z Smart is a portable and lightweight massage gun that offers many features and is HSA-eligible.

A few complaints have been made claiming that the HSA/FSA code does not verify the authenticity of the product. You can still confirm it easily.

Be sure to consult with your doctor before purchasing one to receive their professional advice.

Don’t Miss: Best Massage Spa In Queens Ny

How Can I Use An Hsa/fsa To Cover My Massage

No matter whether you have an HSA or FSA, massage therapy is usually considered a legitimate medical expense by most insurance companies. Still, to be sure, check with your carrier or ask an HR representative at work because some plans do not cover massage, even with a doctors prescription. However, this is not common and most people encounter no difficulty paying for their massage with their HSA or FSA.

After your insurance company confirms that it does endorse massage therapy as medical treatment, call your primary care physician to ask about adding massage to your wellness or treatment plan. Many doctors are willing to provide the prescription through a simple call and do not require you to make an appointment. However, some may still want you to come in so that you can go over your reasons for requesting massage therapy. If you want any help, Dr. McClain who works with us can assist.

Whether or not your doctor wants to see you in person, s/he will probably want specifics about your symptoms. Massage therapy offers beneficial effects for a wide variety of conditions: back pain, stress, depression, anxiety, fibromyalgia, high blood pressure, arthritis, and poor circulation as a complication of diabetes are just some of the symptoms that can be alleviated by massage.

For many insurance plans, a doctors prescription is needed in order for massage to qualify as a legitimate expense for an HSA or FSA.

Is Theragun Fsa Eligible

The Theragun range by Therabody is one of the most popular on the market today. It consists of 4 different massage guns the Theragun Pro, Theragun Elite, Theragun Prime and Theragun Mini. While they call themselves the Worlds Leading Percussive Therapy Devices, there is no mention of FSA or HSA on their official website. Because of this, we must assume they are not officially FSA or HSA approved. You wont be able to use your funds on their website.

However, that doesnt mean you cant use your FSA to buy a Theragun. Approval depends on your insurance company and the type of plan youre on. Recovery For Athletes is a retailer that sells Theragun products that accept FSA and HSA card payments so it may be possible to buy one there. Contact your insurance company to find out if youre eligible, and what steps you need to take to purchase.

You May Like: Massage Magazine Insurance Plus Reviews

How Do I Use My Hsa/fsa

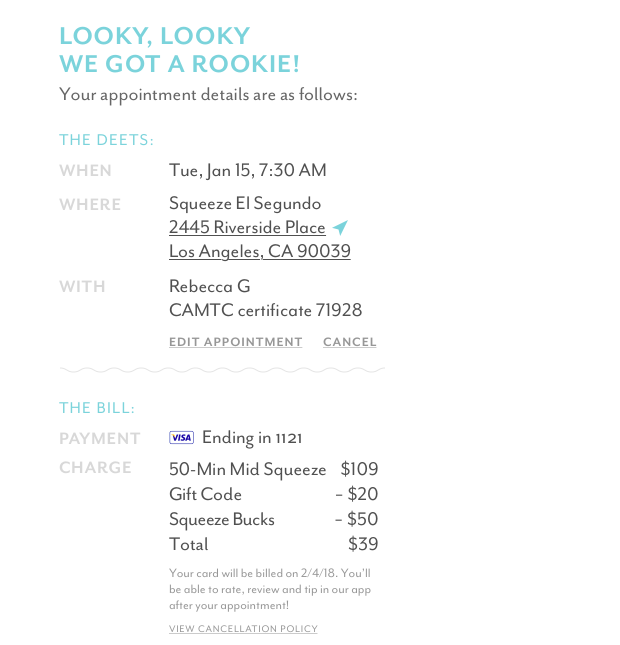

Most HSAs/FSAs come with a Visa type of credit card that can be used in my credit processor. I can take these payments at my office or online when booking appointments. Before the massage, I would check with your insurance provider to make sure that massage is covered as part of the HSA/FSA. Also, no tipping is allowed to be put on these cards. That could get you in trouble as these funds are for medical expenses only.

Some providers request more specific or formal receipts of your massage service for reimbursement in which case, I can provide these for you. Most of the time, my clients have found that using their HSA/FSA card in my office is a breeze.

Using Hsa Or Fsa Funds To Pay For Massage Therapy

Therapeutic massage has many proven health benefits, including improving circulation and reducing blood pressure, decreasing inflammation and pain, and reducing stress and tension.

Examples of conditions helped by massage therapy include carpal tunnel syndrome, tendonitis, stress, hypertension, back pain, sciatica, piriformis syndrome, fibromyalgia, arthritis, diabetes, chronic fatigue, anxiety, depression, and pain management.

You have likely experienced these restorative and pain-relieving benefits for yourself, and have wondered how you might be able to incorporate regular massage therapy into your budget. One way to make regular massages more accessible is by using Health Savings Account or Flexible Spending Account funds to pay for your sessions.

You May Like: How Much Is A Soothe Massage

Recommended Reading: Massage Places In Lakewood Co